使用自定义数据进行Qlib回测

天之道,损有余而补不足;人之道,损不足而奉有余

Qlib是微软出品的开源量化投资平台,包含数据处理、模型构建、交易策略、决策执行、数据分析等一系列功能模块。在对股票市场数据的预测和分析中,我们常常需要对一些模型在历史数据上进行回测。而Qlib提供了这样一个回测框架,能够在自己收集到的数据上进行测试,并输出相应的图形化结果,下面就来试试吧!

数据准备

这里以沪深300指数数据为例子,因为Qlib自带的数据时间只到2020年,所以需要我们自己去下载最新的数据。这里我选择baostock来下载数据,页面中也给出了对应的python代码。在Qlib中指数数据被称为benchmark,与股票市场数据区分开来,具体可以看下面的代码注释:

CSI300_BENCH = "SH000300"

# Benchmark is for calculating the excess return of your strategy.

# Its data format will be like **ONE normal instrument**.

# For example, you can query its data with the code below

# `D.features(["SH000300"], ["$close"], start_time='2010-01-01', end_time='2017-12-31', freq='day')`

# It is different from the argument `market`, which indicates a universe of stocks (e.g. **A SET** of stocks like csi300)

# For example, you can query all data from a stock market with the code below.

# ` D.features(D.instruments(market='csi300'), ["$close"], start_time='2010-01-01', end_time='2017-12-31', freq='day')`

首先可以根据时间测试一下是否有对应的数据,为了方便导入,首先将baostock中的沪深300数据下载下来存储为csv文件,具体代码如下:

from pprint import pprint

import baostock as bs

import qlib

from qlib.constant import REG_CN

import pandas as pd

from qlib.backtest import backtest, executor

from qlib.contrib.evaluate import risk_analysis

from qlib.contrib.strategy import TopkDropoutStrategy

# load lib for benchmark

from qlib.backtest.report import PortfolioMetrics

from qlib.utils.time import Freq

from qlib.utils import flatten_dict

from qlib.contrib.report import analysis_position

# init qlib

qlib.init(provider_uri=r'data/qlib/cn_data', region=REG_CN)

def test_qlib_benchmark(benchmark, start_time, end_time):

benchmark_config = {

"benchmark": benchmark,

"start_time": start_time,

"end_time": end_time,

}

portfolio_metrics = PortfolioMetrics('day', benchmark_config)

print(portfolio_metrics.bench)

def add_qlib_benchmark(index_code, start_time, end_time):

'''

Description: 获取指数(综合指数、规模指数、一级行业指数、二级行业指数、策略指数、成长指数、价值指数、主题指数)K线数据并添加到qlib数据以进行回测

Parameters:

index_code:指数代码,综合指数,例如:sh.000001 上证指数,sz.399106 深证综指 等;

规模指数,例如:sh.000016 上证50,sh.000300 沪深300,sh.000905 中证500,sz.399001 深证成指等;

一级行业指数,例如:sh.000037 上证医药,sz.399433 国证交运 等;

二级行业指数,例如:sh.000952 300地产,sz.399951 300银行 等;

策略指数,例如:sh.000050 50等权,sh.000982 500等权 等;

成长指数,例如:sz.399376 小盘成长 等;

价值指数,例如:sh.000029 180价值 等;

主题指数,例如:sh.000015 红利指数,sh.000063 上证周期 等;

start_time: 开始时间

end_time: 结束时间,要比实际时间+1天

'''

# 登陆系统

lg = bs.login()

# 显示登陆返回信息

print('login respond error_code:'+lg.error_code)

print('login respond error_msg:'+lg.error_msg)

rs = bs.query_history_k_data_plus(index_code,

"date,code,open,high,low,close,preclose,volume,amount,pctChg",

start_date=start_time, end_date=end_time, frequency="d")

print('query_history_k_data_plus respond error_code:'+rs.error_code)

print('query_history_k_data_plus respond error_msg:'+rs.error_msg)

# 打印结果集

data_list = []

while (rs.error_code == '0') & rs.next():

# 获取一条记录,将记录合并在一起

data_list.append(rs.get_row_data())

result = pd.DataFrame(data_list, columns=rs.fields)

# 结果集输出到csv文件

result.rename(columns={'code':'symbol'},inplace=True)

result.loc[:, 'symbol'] = "SH000300"

result.to_csv(r"data/csv/SH000300.csv", index=False)

print(result)

# 登出系统

bs.logout()

# init qlib

qlib.init(provider_uri=r'data/qlib/cn_data', region=REG_CN)

try:

test_qlib_benchmark('SH000300', "2023-03-06", "2023-08-24")

except ValueError:

print('Please add SH000300 csv data with "add_custom_benchmark.sh"!')

add_qlib_benchmark('sh.000300', "2023-03-06", "2023-08-25")

exit(0)

在回测时,沪深300的成分股市场数据也需要导入到Qlib中来计算超额收益,同样地我将它们存成了csv格式,示例代码如下:

def transform_qlib_format(df):

sym = np.unique(df['symbol'])

#np.savetxt(r'data/csi300.txt',sym,fmt='%s')

for i,isym in tqdm(enumerate(sym)):

ohlcv_filter = df[df['symbol'] == isym]

ohlcv_filter.to_csv(r'data/csv/'+isym+'.csv', index=False)

注意要将股票代码的列名命名为symbol,其它列名一般就是包含开盘价(open)、收盘价(close)、最高价(high)、最低价(low)、交易量(volume)。然后就是根据官方提供的工具,将数据导入Qlib目录,具体bash脚本如下:

#!/usr/bin/bash

FILE="./dump_bin.py"

if [ -f "$FILE" ]; then

echo "$FILE exists."

else

echo "$FILE does not exist! try download from github using curl"

curl -O https://raw.githubusercontent.com/microsoft/qlib/refs/heads/main/scripts/dump_bin.py

fi

FILE="./data/qlib/cn_data"

if [ -f "$FILE" ]; then

echo "$FILE exists."

else

echo "$FILE does not exist! Creating folder..."

mkdir -p data/qlib/cn_data

fi

python dump_bin.py dump_all --csv_path data/csv --qlib_dir data/qlib/cn_data/ --include_fields open,close,high,low,volume --symbol_field_name symbol --date_field_name date

然后再次运行一下上面的test_qlib_benchmark函数,应该能够正常读到数据。

模型回测

这里模型回测需要用到自己的模型预测的输出,同样也存储成csv文件。列名分别是:datetime,instrument,score,label。然后就可以配合官方的回测代码进行测试,我修改后的代码如下:

#def backtest_custom_benchmark(BENCH: str = "SH000300", start_date: str = "2023-03-06", end_date: str = "2023-08-24", pred_score: pd.Series=pd.Series([],dtype=int)):

"""

Backtest with custom benchmark

"""

# Benchmark is for calculating the excess return of your strategy.

# Its data format will be like **ONE normal instrument**.

# For example, you can query its data with the code below

# `D.features(["SH000300"], ["$close"], start_time='2010-01-01', end_time='2017-12-31', freq='day')`

# It is different from the argument `market`, which indicates a universe of stocks (e.g. **A SET** of stocks like csi300)

# For example, you can query all data from a stock market with the code below.

# ` D.features(D.instruments(market='csi300'), ["$close"], start_time='2010-01-01', end_time='2017-12-31', freq='day')`

pred_score = pd.read_csv(r'data/output/test.csv')

pred_score["datetime"] = pd.to_datetime(pred_score["datetime"])

pred_label = pred_score.set_index(["instrument", "datetime"])

pred_score = pred_score.set_index(["datetime", "instrument"])["score"]

STRATEGY_CONFIG = {

"topk": 50,

"n_drop": 5,

# pred_score, pd.Series

"signal": pred_score,

}

EXECUTOR_CONFIG = {

"time_per_step": "day",

"generate_portfolio_metrics": True,

}

backtest_config = {

"start_time": "2023-03-06",

"end_time": "2023-08-24",

"account": 100000000,

"benchmark": "SH000300",

"exchange_kwargs": {

"freq": "day",

"limit_threshold": 0.095,

"deal_price": "close",

"open_cost": 0.0005,

"close_cost": 0.0015,

"min_cost": 5,

},

}

# strategy object

strategy_obj = TopkDropoutStrategy(**STRATEGY_CONFIG)

# executor object

executor_obj = executor.SimulatorExecutor(**EXECUTOR_CONFIG)

# backtest

portfolio_metric_dict, indicator_dict = backtest(executor=executor_obj, strategy=strategy_obj, **backtest_config)

analysis_freq = "{0}{1}".format(*Freq.parse("day"))

# backtest info

report_normal, positions_normal = portfolio_metric_dict.get(analysis_freq)

# analysis

analysis = dict()

analysis["excess_return_without_cost"] = risk_analysis(

report_normal["return"] - report_normal["bench"], freq=analysis_freq

)

analysis["excess_return_with_cost"] = risk_analysis(

report_normal["return"] - report_normal["bench"] - report_normal["cost"], freq=analysis_freq

)

analysis_df = pd.concat(analysis) # type: pd.DataFrame

# log metrics

analysis_dict = flatten_dict(analysis_df["risk"].unstack().T.to_dict())

# print out results

pprint(f"The following are analysis results of benchmark return({analysis_freq}).")

pprint(risk_analysis(report_normal["bench"], freq=analysis_freq))

pprint(f"The following are analysis results of the excess return without cost({analysis_freq}).")

pprint(analysis["excess_return_without_cost"])

pprint(f"The following are analysis results of the excess return with cost({analysis_freq}).")

pprint(analysis["excess_return_with_cost"])

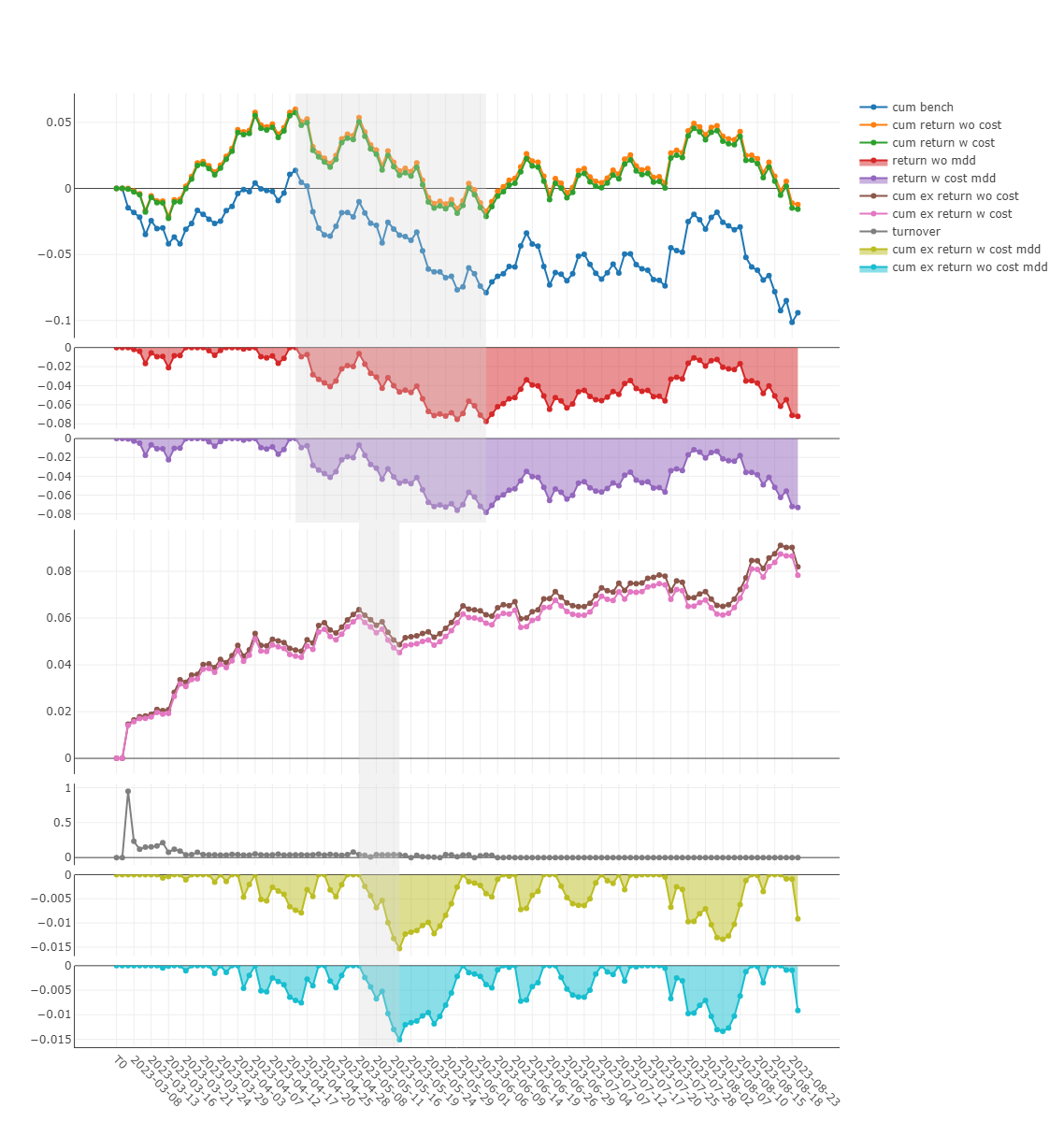

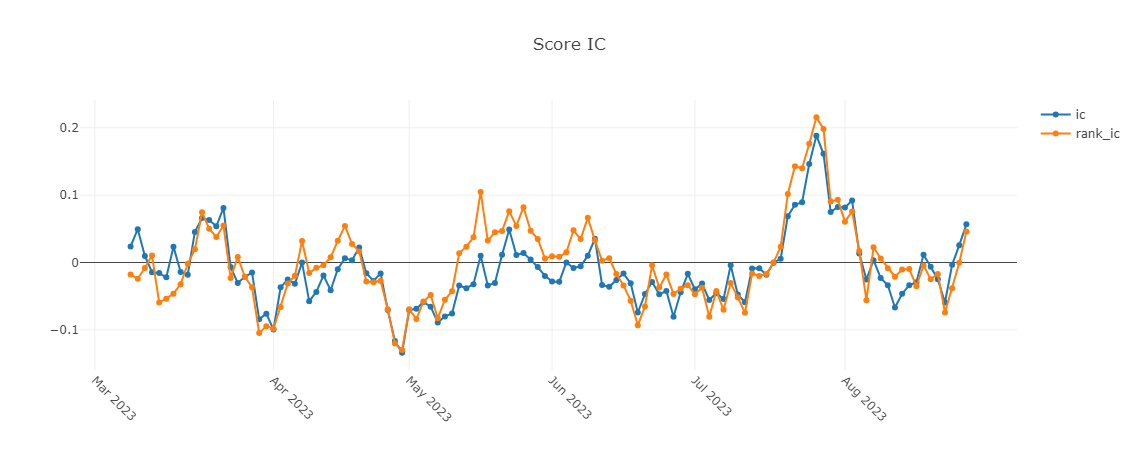

最后还可以拿工具画出回测结果分析图,如下:

analysis_position.report_graph(report_normal)

analysis_position.score_ic_graph(pred_label)

| 微信(WeChat Pay) | 支付宝(AliPay) |

|

|

| 比特币(Bitcoin) | 以太坊(Ethereum) |

|

|

| 以太坊(Base) | 索拉纳(Solana) |

|

|